How to Get Sim Withholding Tax Deduction Certificate from All Companies

How to Get Sim Withholding Tax Deduction Certificate

Introduction

Almost all telecommunication companies provide tax deduction certificates in Pakistan, requesting their customers to have one. But unfortunately, a majority don’t pay attention to it. You might have heard about withholding tax deduction certificates for SIMs if you are a Pakistani citizen. Many people are aware of the tax certificate, but they don’t know its usage and benefits.

Their lack of knowledge of withholding tax results in the reduction of certain benefits that Government provides. However, people who are aware of the benefits of withholding tax pay special attention to it. In fact, they take all the necessary action to get it as soon as possible.

Simply speaking, a withholding tax deduction certificate allows you to monitor all of your taxes paid to the Government. Either you pay it while recharging or through any other resource. Whenever the Government deducts a tax through any telecom company, Government will only note if you have a withholding tax deduction certificate.

Importance of Withholding Tax Deduction Certificate

Obviously, keeping all the taxes in the record of the Government is important. But withholding a tax deduction certificate brings a person many more benefits than that. A withholding tax deduction certificate allows the Government to record the income of employed and self-employed personals. Due to this reason, many governments emphasize having a withholding tax deduction certificate.

Moreover, you can claim adjustments & discounts on your annual taxes if you have a withholding tax certificate. Companies provide deductions in annual charges to customers having tax deduction certificates. The benefits make this certificate a great thing to have.

So, let’s learn about the methods to get tax certificates from different companies.

Ufone Tax Certificate

Ufone is one of the biggest telecommunication companies in Pakistan. More than 40% of people use Ufone SIMs for their communication purpose within the country and worldwide. Due to this reason, they were one of the first to introduce the tax certificate to leverage their customers financially.

There are two simple methods of getting a Ufone tax certificate.

- Through the website

- Through the application

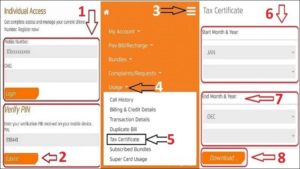

Ufone Tax Certificate Online

Getting a tax certificate from the official website of Ufone is a matter of few minutes despite the verification process. Have a look at the steps mentioned below, and you will be clear with the process.

- Visit the official website of Ufone. (https://www.ufone.com/)

- Create your online portal by verifying your email.

- Now, go to Tax Certificate in the usage dropdown.

- The website will download the certificate instantly.

Ufone Tax Certificate through Ufone App

To have a Ufone tax certificate through the mobile application, you need to download the application from the play store. Once you have downloaded the application, following the below-mentioned rule will get you a Ufone tax deduction certificate.

- Create a new account on the application by verifying your phone number

- Once done, click on the tax tab button

- Then, select the tenure

- After selecting the tenure, the app will download it if you click ok

Zong Tax Certificate

Zong is a Chinese-owned company providing 4G services to Pakistani customers for communication. They are one of the top-notch companies having no comparison with other companies as far as their service is concerned. Their customers are delighted with their services as they never compromise on quality.

So, how would they remain behind in this regard? Obviously, they are also providing a tax certificate, which can be accessed by following two different methods.

- Zong Tax Certificate from e-care

- Tax certificate of Zong from a mobile application

Source Image: Apna4G

Source Image: Apna4G

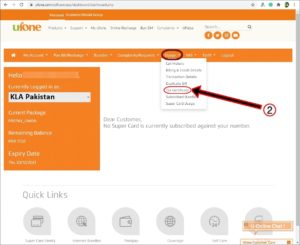

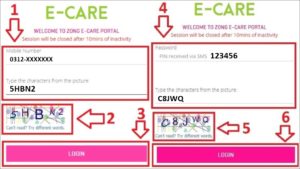

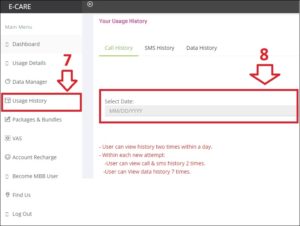

Zong Tax Certificate from E-Care

You can easily get a tax certificate through the official website of Zong. You need to follow all the steps mentioned below for an easy download of the certificate.

- Visit the website of Zong (https://ecare.zong.pk/)

- Now create your account & verify it

- After the verification, you will see an online portal

- Click on the usage history tab

- Now enter the time

- You will get the certificate

Zong Tax Certificate through Zong App

The following method to get the certificate is by using an online application. You need to download the application to proceed with the process of certificate creation. Once you have downloaded the application, you should follow the following method.

- Login to your account by verifying it

- Go to the options tab

- Now click on the tax certificate

- The next step is to enter the start & end date

- The application will start downloading the tax certificate of the selected date

Telenor Tax Certificate

If you’re a Telenor user, you must be searching for having a Telenor tax certificate. Well, if this is the case, we will thoroughly guide you and help you get the Telenor tax deduction certificate. There are two methods by which you can get your Telenor tax certificate.

So, let’s have a look at each one of them in detail.

- Telenor Tax Certificate through Email

- Tax certificate by chat support & helpline

Telenor Tax Certificate through Email

Telenor Tax Certificate through Email

Getting a certificate through email is an extremely easy process. You can simply email your concerns with a start and end date to telenor345@telenor.com.pk along with the following documents.

- Pictures of front and back of CNIC

- Your Telenor number

- Details of tenure

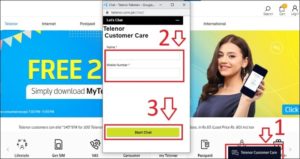

Telenor Tax Certificate by Chat Support & Helpline

The simplest method to get a Telenor tax certificate is by contacting support directly. You can simply contact the support by calling their helpline number (345) or contacting the chat support.

Jazz Tax Certificate

Jazz Tax Certificate

Mobilink Jazz is the biggest telecommunication company in Pakistan. They have millions of customers all over Pakistan. They provide their customers many benefits, including the tax deduction certificate. Also, their process of getting the tax certificate is the easiest one.

You can quickly get the jazz tax certificate by following two methods.

- Tax certificate of Jazz through WhatsApp

- Jazz tax certificate through the mobile application

Source Image: Apna4G

Source Image: Apna4G

Jazz Tax Certificate through WhatsApp

If you use WhatsApp, getting a tax deduction certificate will not be an issue. Just follow all the steps, and you will be having the tax deduction certificate on your mobile.

- Send a message to 0300-3008000

- They will send you a reply with several packages

- Then, select 6 “Tax Certificate” written on it

- The customer support will provide you the certificate.

Jazz Tax Certificate through Jazz App

You can get the tax by following some simple steps through a mobile application. But before you proceed, you must have the application downloaded.

- Select the menu

- Go to support

- Click on the Jazz tax certificate

- Then select the year

- The app will start downloading the certificate

Conclusion

Mobile companies have made the getting process of tax certificates extremely easy. Customers should pay attention to the withholding of tax deduction certificates for their benefits. It may save you a fantastic handsome amount if you recharge a lot of times.

How KLA Pakistan Can Help

KLA Pakistan is one of the best legal & accounting service providers in Pakistan. We provide top-notch accounting & bookkeeping services, tax advisory & compliance services, company registration services, NTN registration services, and others. Our experts have years of experience in legal consultation and accounting & bookkeeping, which helps us completely resolve your issue.

Contact us for any of your legal and taxation help, Consult Our Professionals.

Show Us Your Love, Join Us At:

Leave a Reply

Want to join the discussion?Feel free to contribute!