Debits and Credits

Debits and Credits

There is one thing in accounting that trips people off is understanding “Debits and Credits“.

Businesses struggle to understand the concepts of debits and credits to manage the transactions of a company. They search for professional companies to outsource their financial management services. The major reason is the lack of understanding of cash flow. It is essential for businesses to understand the basic concepts so that they can outsource without much hustle.

So, lets learn some of the basics of debits and credits.

What are Debits and Credits?

Debits and Credits in accounting are two sides of the coin. Debit is the amount of money that goes out from an account. On the other hand, credits are defined as the amount that comes into an account.

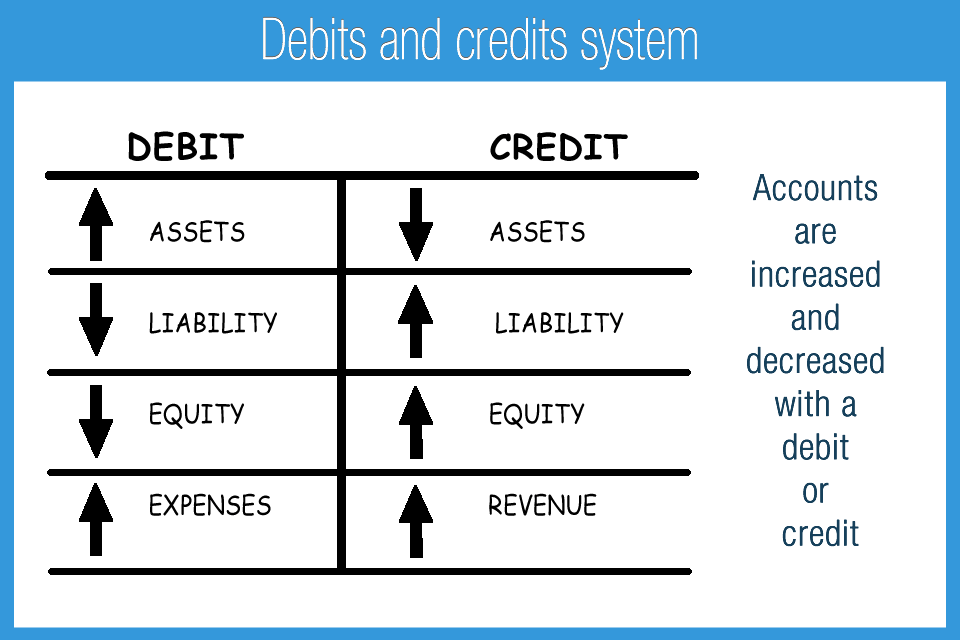

Simply put, whenever you add or subtract money from an account, you’re debiting or crediting the money into the account. So, this is where it gets tricky – depending on the account in question, debiting can cause the amount to increase or decrease. Similarly, the credits can be defined in the same way.

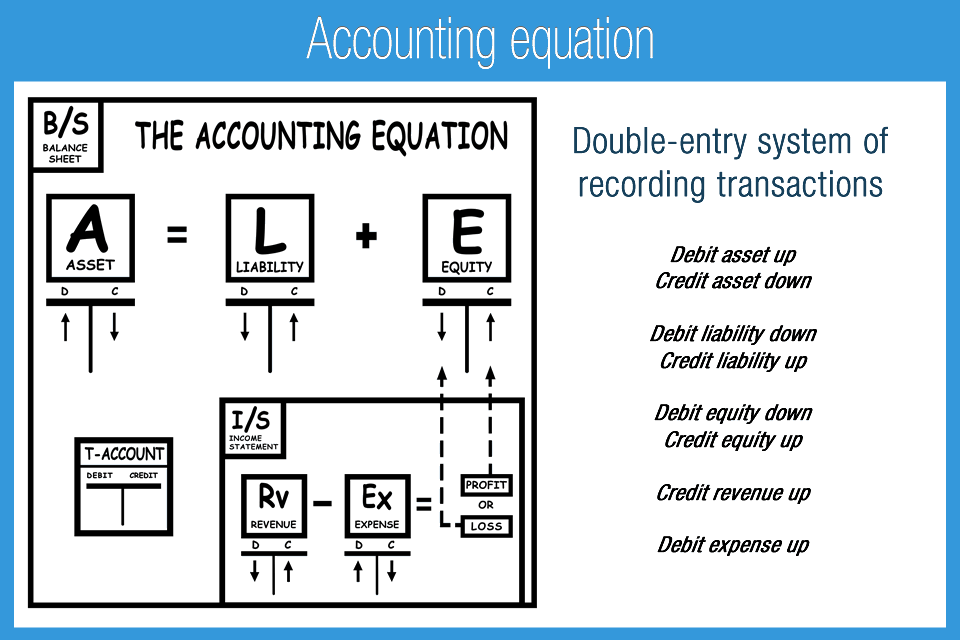

So, to dive deep into debits and credits, you first need to understand the concept of double-entry accounting. However, before jumping on the bandwagon, let’s understand the five types of accounts to avoid confusion while you are reading the post.

- Assets: Resources that are owned by businesses that have economic value that can be converted into cash. (for example, equipment, cash, vehicles, property)

- Expenses: Costs that occur during business operations (for example, wages, supplies)

- Liabilities: It is the amount owed to another person or business (for example, accounts payable)

- Equity: It is defined as your assets minus your liabilities

- Revenue and Income: They are cash earned from sales

What is Double-Entry Accounting

Double-entry accounting states that at least two accounts in the chart of accounts are affecting in equal and opposite ways for every financial transaction recorded. Also, this method is generally used within the business’s general ledger and ultimately gives you the basis of your financial reports. Moreover, these reports are in the form of balance sheets and income statements. So, every time you spend money or earn money, remember, one account will be debit, and one will be credit. That’s why many business owners and entrepreneurs hire companies such as KLA Pakistan providing quality accounting and bookkeeping services.

How Debit and Credit Works?

Whenever you make a bill payment or purchase something, your account sees a deduction, which is defined as debit. On the other hand, the purchase makes the amount flow into someone else’s account, which is defined as credit.

Here, two accounts are used simultaneously. So, it is essential to understand who goes in a ledger. So, debits increase the balance of assets, losses and, expenses. On the other hand, Credits increase the balance of revenue, income, gains, liability, and shareholder equity.

Suppose you purchase goods for your shop from the wholesaler for a total of $500. In this case, you would debit the amount for buying supplies and credit the account into the payee’s account.

Many companies provide professional accounting and bookkeeping services to handle the accounting needs of corporations. These companies tailor their services according to the size of corporations.

The Three Rules of Accounting:

Here is a rule, there is no lie in saying that Debits and Credits run the accounting and bookkeeping services. Moreover, here are the three main rules of accounting.

Debits and credits run the accounting and bookkeeping services. So, let’s understand the three main rules of accounting in detail.

Rule# 1: Debit the curator and credit the creditor

Rule# 2: Debit the incoming account and credit the outgoing amount

Rule #3: Debit losses and expenses, credit gains, and income.

1. Debit the Curator and Credit the Creditor:

The first golden rule of accounting comes into play with personal accounts. Defining this, a personal account is a ledger account that belongs to individuals or organizations. When a business or the receiver holding a personal account receives something from another business or individual, the business receiving from the other business becomes the receiver, and the business giving it becomes the giver.

Let’s consider the example of buying a gift of $50 from a gift shop. But applying the first rule of accounting on the example should reflect a debit or transaction from the personal account and a credit to the business account. So your transaction will be displayed as follows.

| Date | Account | Debit | Credit |

| XXXX | Personal Account | $50 | – |

| Gift Shop | – | $50 |

2. Debit the Incoming Account and Credit the Outgoing Amount:

The second rule is for real accounts. A real account is an asset account, a liability account, or an equity account. In a real account, a person can see his account recovered in balance at the end of the year.

Suppose you purchase furniture with $2000 in cash. Now, applying the second rule of accounting to this example, when a business receives something of value such as in exchange for cash, it is represented as debit. Similarly, if something of value goes out, you can define it as credit. This example should be represented as:

| Date | Account | Debit | Credit |

| XXXX | Furniture Account | $2000 | – |

| Cash Account | – | $2000 |

3. Debit Losses and Expenses, Credit Gains and Income:

The third golden rule of accounting deals with smaller accounts. It is one in which people store their yearly transactions. This allows the accounting and bookkeeping services such as KLA Pakistan to reset the balance to zero and starting fresh. Because nominal accounts are associated with an individual or business’s expenses, gains, losses, and revenues.

Suppose you purchased goods for $3000 from XYZ company. By applying the third rule of accounting, if a business earns a profit or gains income by purchasing it is represented as credit.

| Date | Account | Debit | Credit |

| XXXX | Purchase Account | $3000 | – |

| Cash Account | – | $3000 |

Conclusion

Debits and Credits can be hard to understand sometimes but once you do they don’t require many problems. So, a person should go through all the basics to get better at debits and credits. The most critical concept to understand about debits and credits is that the total amount of debits must be equivalent to the total amount of credits. Moreover, it is imperative to balance each transaction in double-entry accounting to have an accurate general ledger, financial statements of the transactions made, and a look into the business’s financial health.

For All Your Bookkeeping Requirements, Consult Our Professionals.

You might find these further useful articles:

Why you should Audit your Financial Statement

Advantages of Company Registration in Pakistan

Benefits of FBR NTN online Verification

Get Sim Withholding Tax Deduction Certificate

Show Us Your Love, Join Us At:

Leave a Reply

Want to join the discussion?Feel free to contribute!